Using IR Surveys in Personal Insurance Pre-Loss Inspections

InfraMation 2013 Application Paper Submission

Austin Tucker

Fireman's Fund Insurance Company

INTRODUCTION

In the world of homeowners insurance, the inevitable cost of doing business is claims and the subsequent claims payment. The insurance industry has partnered with municipal services like fire and police departments to mitigate losses with tools like smoke detectors and the introduction of personal property inventories, “Take, Lock, Hide” programs, and the installation of burglar alarms. The rising numbers of water losses, however, have yet to be addressed with public education outside Federal Flood programs.

While most programs that aim to develop awareness about water damage mitigation in the public sector are struggling to get out of their infancy, some insurance companies are taking steps to catch water damage before it can become an issue with an individual homeowner or business. These pre-loss steps include preventative measures such as alarm moisture sensors around appliances to more proactive approaches such as the use of infrared cameras to find leaks before they are visible. While the thermal imagining approach is slow and methodical, the results speak for themselves on its effectiveness. This paper shows that thermal imaging to avoid water losses already demonstrates positive effects for both cost savings and customer service. Furthermore, the potential of the application has just begun to be explored.

The use of infrared scanning is a relatively new phenomenon in homeowners insurance and, in particular, Fireman’s Fund. This paper examines the early results of infrared camera use among Risk Services Consultants trained as Level 1 thermographers and analyzes the cost/benefit from the program by looking at completed thermographic scans from homes with possible water anomalies in the past year. Also presented are selected case studies from Risk Service personnel in the field along with an exploration of potential future applications for this technology in the industry.

WHO IS FIREMAN’S FUND AND THEIR RISK SERVICE ADVISOR?

Fireman’s Fund Insurance Company was founded in 1863 in San Francisco. Named for an arrangement to pay 10% of company profits to provide support for the windows and orphans of firefighters, the company continues this tradition today with its Heritage Program. This program provides support to fire departments around the country through grants and “volunteer support to local fire departments, national firefighter departments, national firefighter associations and burn prevention programs at non-profit organizations.” Today Fireman’s Fund specializes in providing insurance needs to both affluent clients as well as to business, the movie industry, and farm and ranch services.

Within Fireman's Fund Insurance Company, the first contact for insured clients is usually a Personal Lines Risk Advisor who provides an accurate replacement cost on property as well as offering advice on-site for mitigation of potential risks. These risks may include, but are not limited to heat and smoke detector placement, home maintenance issues that may pose a danger to the homeowner and/or guests, and water damage mitigation. The consultant also locates home credits for the insured that may have gone unnoticed during the policy writing period.

REASONS AND ASSUMPTIONS FOR THE STUDY

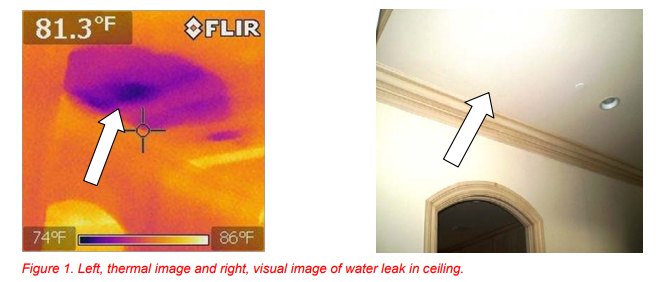

As stated earlier, using thermal imaging devices in the field is a relatively new in this field, particularly for the personal side of the business. Although data is still being collected and correlated for more elaborate cost-benefit analysis theorems and charts, this paper will concentrate on the straightforward cost saving potential provided by a thermography program. To accomplish this task, the following assumptions have been made to round out the data for analysis:

- The data for the calendar year of 2013 will not be complete as of paper’s submission in July. Therefore, some information is duplicated in order to “round out” data.

- Data obtained begins in the middle of 2012, so a “rolling” 12 month year is used.

- Like a traditional calendar year, this “rolling” year has 4 quarters (3 months each), but they are not typical quarters given the months that they fall in.

- The third and fourth quarter results are an average of the first two quarters results. ((Q1R + Q2R)/ 2 = Result used for Q3 and Q4).

- Average Fireman’s Fund Insurance deductible is $3,000.

- Average National Homeowner’s insurance deductible is $500.

- The average water loss for a Fireman’s Fund insured is assumed to be $25,000.

THE STUDY

The thermal imaging program at Fireman’s Fund began in August of 2012 with an initial group of consultants who piloted the program to its second rollout of training at which point in January of 2013, several more consultants were added. This puts the current thermal imaging team level at just under one third of all Risk Services Personal Lines personal. With data gathered from nearly a year of thermal imaging, the sample size has been deemed sufficient to examine the benefit of the program. Preventative infrared imaging to detect possible water anomalies with FLIR cameras was performed on-site by a Fireman's Fund Risk Service thermographer.

In order to gain a useable model for the purpose of this paper, a look at twelve (12) months of data was done. Eighteen average thermal scans are performed during inspections each month, with an assumed 54 inspections per quarter, and 216 a year. At our current staffing level, we can project that around 10%

of these inspections turn up water anomalies, giving a result of 1.8 anomalies per month. The yearly cost savings can be assumed at around $180,000 with this data.

It should be noted that no claims were filed for any of these surveys in which an anomaly was found. This data alone demonstrates the potential cost savings for the Fireman’s Fund insuree: definitely less than the average $2,500 deductible and, possibly, below the national average deductible of $500. By addressing the needed repair before significant water damage actually occurred, the home owner can be assumed to have saved around $2,000 re deductible costs as well as immeasurable amounts of inconvenience and hassle in the repairs.

The benefits of this program are extending to the agency side of the insurance business. These agents can easily see how thermal imaging cannot only potentially reducing loss exposures, but can be used to demonstrate that Fireman’s Fund is taking steps to ensure a strong customer service experience with its Risk Management program.

The question of “How measurable is this data?” can only be answered by comparing it to previous data from before cameras were used. This could conceivably result in the limited set of data presented here being “picked apart.” To avoid this issue, what is needed, of course, is both a larger sample size from a larger data pool, and, even more importantly, time. With that in mind, we can postulate that as the sample

size increases, the claim average of $25,000 will decrease due to the number of these inspections being done and catching anomalies early on, thus decreasing the size and impact of the savings.

CASE STUDIES

While the numbers can give a good broad overview of the impact of the thermography program with Fireman’s Fund Risk Services group, case studies can best demonstrate the program’s effectiveness in the field. While this program is still taking off and the learning curve is still steep, the anomalies seen in these examples show how far this program has come in its short existence.

All of the following examples are from actual inspections done by Fireman's Fund Risk Services Advisor - Personal Lines employees who are certified Level 1 thermographers in the normal course of their duties in inspecting a home.

CASE STUDY #1

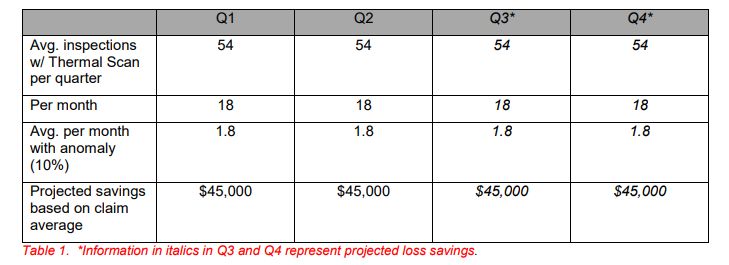

A Fireman's Fund Risk Advisor was preforming a thermal scan of a newly built residence. During this scan, a large cold spot was noticed on the first floor in the game room area of the home. The camera showed a large cool area on the ceiling of a room indicating a water leak that was not yet visible to the naked eye.

The consultant went upstairs to the room above the water leak to investigate further and found a wet bar in the upstairs room. A scan of the bar showed that a water leak was coming from the area around the ice maker.

The consultant informed the homeowner about the discovery who then immediately told the building contractor about the issue. The contractor came out and pulled out the ice maker to discover that the leak was emanating from the back of the ice machine where an over-tightened plastic clip had cracked during its installation. The contractor replaced the part and dried the sheetrock areas where moisture was originally seen by Risk Consultant.

The loss savings on this early detection have been estimated at around $250,000. With early detection, the leak was repaired quickly for only $50. While the scale of this find is not typical, it is a good example of how useful and powerful the camera is to the not only Fireman’s Fund, but to the homeowner as well.

CASE STUDY #2

-

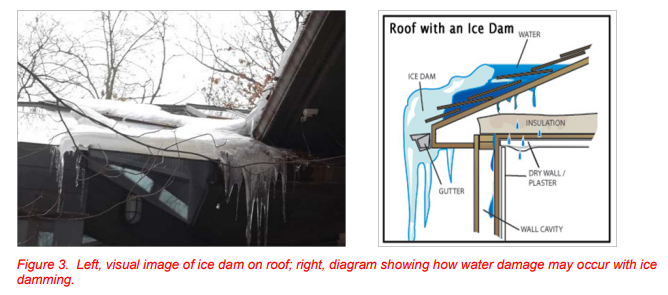

In this example, the thermal camera reveals a water anomaly resulting from an ice damming along a roof line. Ice damming occurs when excessive heat in the attic causes snowmelt on the roof via heat loss in the attic. The snow runs down the roof slope and refreezes in an area where the heat is not as excessive. Once there, the newly formed ice dam blocks any water from draining off the roof. The excessive water then leaks through the roof into the attic, insulation, and drywall causing damage.

-

This particular incidence of ice damming was found in a home Michigan where the water behind the dam had begun to seep through the home’s insulation and into the kitchen area.

-

While these pictures do show water damage, there may also be an underlying issue of heat loss in the attic that caused the ice damming to occur. Both the water damage and area of heat loss will need to be addressed when repairs are made (which are still ongoing at time of this paper).

CASE STUDY #3

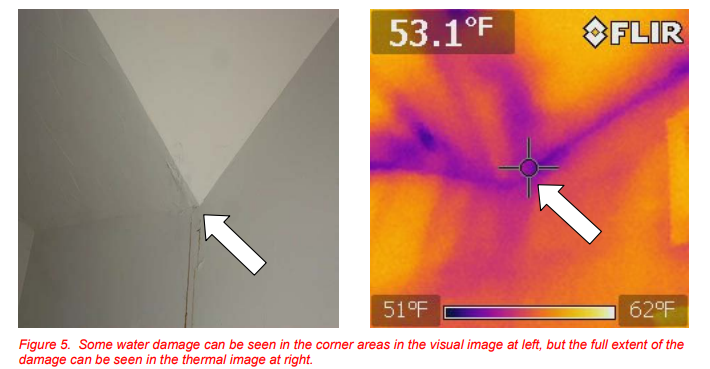

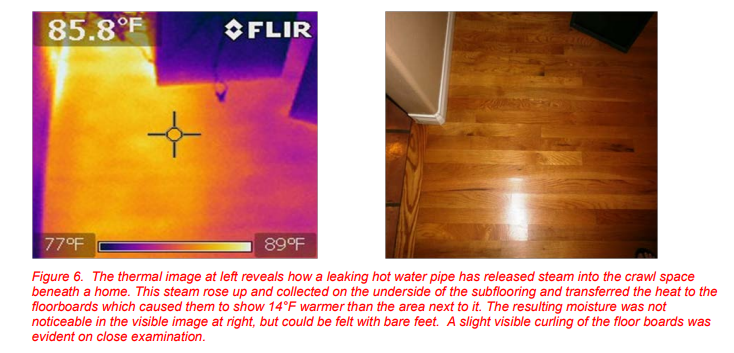

The thermal imaging camera is often used to find cool spots, caused by water leaks, that show up in sheetrock or plaster in stark contrast to the warm walls and ceilings that are being surveyed. However, when the leak occurs in pipes and tubing carrying hot water to a variety of appliances and areas the subsequent anomaly is not seen as a cool spot, but rather a spot (or area) that shows hotter than the average room temperature.

CONCLUSIONS AND POSSIBLE FUTURE OF IR IN PERSONAL LINES

The future of thermography for insurers and insurees in water loss mitigation and associated cost savings is bright. Added applications such as locating hot breakers in residential breaker boxes and finding missing insulation in homes for energy-saving purposes along with a multitude of as-yet-undiscovered uses will make thermal imaging an invaluable tool to Risk Advisors in the course of doing their job.

Whether mitigating potential losses (water damage prevention) or providing better customer service (energy conservation), infrared technology provides significant benefits to all involved. As Fireman’s Funds’ IR inspection program rolls onward and begin to show its full benefit for water mitigation, new avenues will naturally show themselves and create the need for additional certified IR professionals camera.

ACKNOWLEDGEMENTS

The authors wish to thank all the staff of Fireman’s Fund Insurance Company that assisted in the collection of data that made this paper possible.

ABOUT THE AUTHOR

Austin Tucker is a Level 1 thermographer with over 10 years of experience in the personal insurance industry.